Buy Crypto

Assets

Wrapping cryptocurrencies enables interoperability between varying networks and allows users to trade their assets on other ecosystems typically native to a singular blockchain.

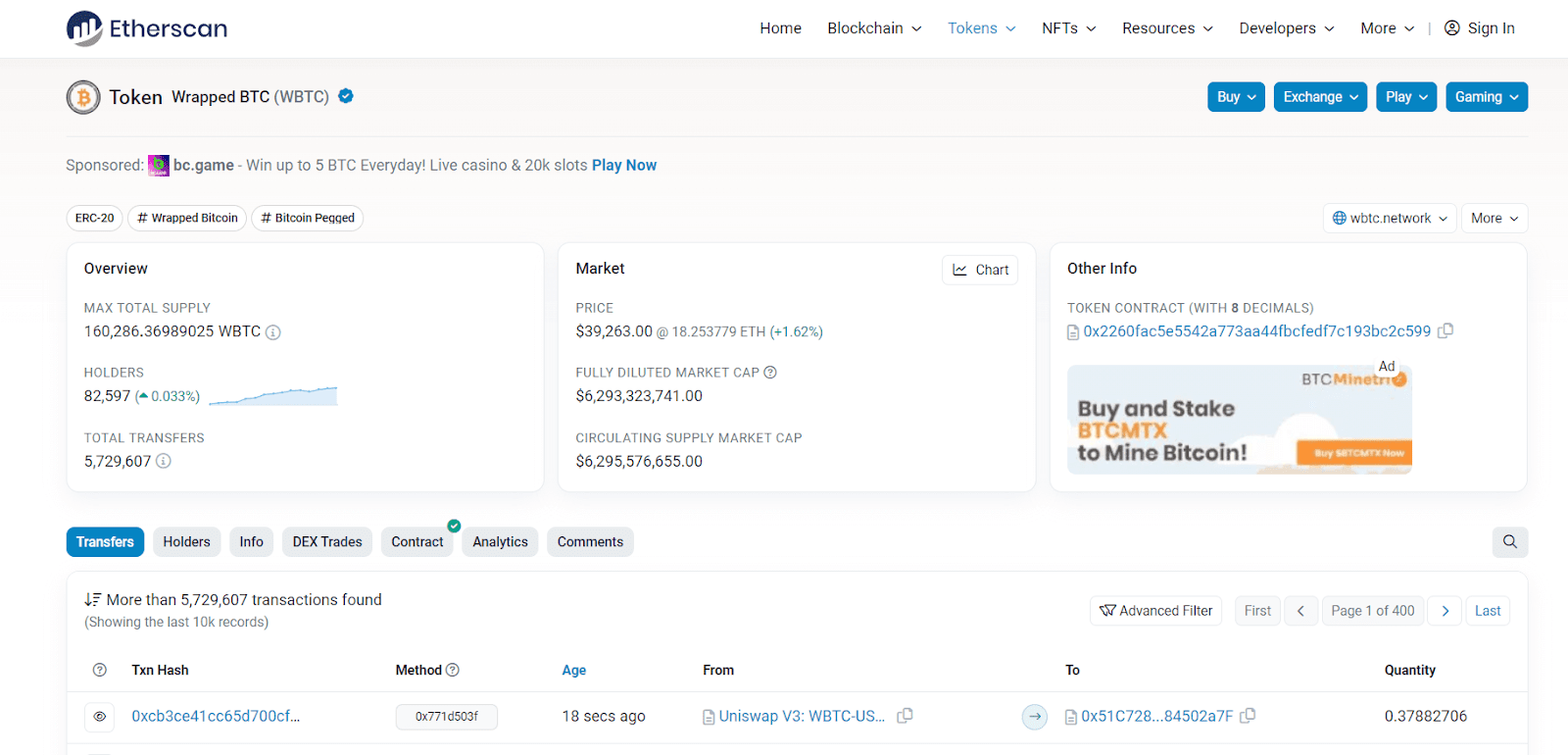

Wrapped Bitcoin (WBTC) is the most commonly wrapped crypto asset. It represents a tokenized rendition of Bitcoin that operates on the Ethereum network and is backed by Bitcoin in a 1:1 ratio.

In essence, WBTC bridges the limitations of Bitcoin's native blockchain, facilitating its integration into Ethereum's vibrant DeFi landscape while allowing Bitcoin holders to retain exposure to Bitcoin’s intrinsic value.

The unique design of WBTC allows it to combine the liquidity and stability of Bitcoin with the flexibility and programmability of Ethereum. It serves as a bridge between the Bitcoin and Ethereum networks, enabling Bitcoin to be used in decentralized applications (dApps) and smart contracts on the Ethereum network.

Initially, cryptocurrencies such as Bitcoin and Ethereum operated independently on their respective blockchains, limiting the ability to utilize assets across different platforms.

The idea of wrapped tokens originated from the need to bridge this interoperability gap by enabling the representation of assets from one blockchain to another.

Creating a wrapped cryptocurrency begins with tokenization, wherein an asset such as Bitcoin or Ethereum is digitized into a token format. To facilitate this transition, custodians hold the original assets and issue equivalent amounts of wrapped tokens on the target blockchain.

For example, if an individual desires to use Bitcoin on Ethereum, a custodian will securely hold the Bitcoin and issue an equivalent amount of WBTC on Ethereum's network.

These wrapped tokens are then freely tradable and transferable between both blockchain ecosystems. Users can engage with wrapped tokens through DEXs, DeFi protocols, and other applications and smart contracts.

The creation of WBTC involves a process known as "wrapping". In this process, Bitcoin is deposited into a custodial vault, and the equivalent amount of WBTC is minted on the Ethereum blockchain. This ensures that the supply of WBTC is backed by an equal amount of Bitcoin, maintaining a 1:1 pegged asset.

In essence, the process of wrapping Bitcoin transforms it into a new form that can be used on the Ethereum network. This allows Bitcoin holders to participate in Ethereum's growing decentralized finance (DeFi) ecosystem, opening up a world of possibilities for cross-chain interactions.

The concept of Wrapped Bitcoin is just one example of the innovative solutions being developed in the world of blockchain and cryptocurrency. As this technology continues to evolve, one can only imagine what other breakthroughs await us in the future.

The unwrapping process for WBTC involves redeeming the wrapped tokens for the underlying BTC held in custody by the custodian.

Initially, a user holding WBTC tokens initiates a redemption request to exchange them for the equivalent amount of Bitcoin. This action may be driven by the need to withdraw Bitcoin from the Ethereum ecosystem or conduct transactions outside Ethereum-based applications.

The redemption request is processed through designated smart contracts governing the WBTC system, facilitating and regulating the redemption process. These smart contracts play a crucial role in enforcing the rules and conditions associated with token redemption, ensuring compliance and security throughout the process.

Upon verification of the redemption request by the custodian, who holds the reserve of Bitcoin backing the WBTC tokens, the equivalent amount of Bitcoin is released to the user. This "burns" the WBTC tokens, removing them from circulation while providing the user with the redeemed Bitcoin.

Custodians maintain detailed records of redeemed WBTC tokens and corresponding Bitcoin transactions to keep accountability. These records serve as evidence of the burning process.

The ability to unwrap WBTC into Bitcoin holds significance for users, as it provides liquidity and legitimacy. It allows users to convert their WBTC holdings into the underlying asset (Bitcoin) whenever necessary, enhancing the utility and reliability of wrapped tokens in DeFi-centric DApps.

Wrapped Bitcoin (WBTC) plays a significant role in the Decentralized Finance (DeFi) sector. This section explores how WBTC is used in decentralized applications (dApps) and smart contracts on the Ethereum network.

WBTC is an ERC-20 token that represents Bitcoin on the Ethereum blockchain. The process of wrapping Bitcoin allows it to be used in decentralized applications (dApps) within the Ethereum ecosystem.

By standardizing Bitcoin to the ERC-20 format, wrapped assets like WBTC become compatible with Ethereum dApps. This interoperability opens up a range of possibilities for developers and users, allowing Bitcoin to be utilized in Ethereum-based dApps, thereby expanding Bitcoin's functionality and use cases.

For instance, WBTC can be traded on decentralized exchanges (DEXs) and used as collateral for loans or other financial activities within the Ethereum ecosystem. Additionally, WBTC can be used in various DeFi applications, such as lending, borrowing, and decentralized exchanges, providing Bitcoin holders with access to an expanded range of financial services and opportunities.

Another major use of WBTC in the DeFi sector is its integration into smart contracts on the Ethereum network. As an ERC-20 token, WBTC follows a set of standards defined for tokens on the Ethereum blockchain. These standards include transfer and balance functions, as well as other features that allow for compatibility and interoperability with other Ethereum-based applications.

The use of WBTC in smart contracts enables Bitcoin holders to participate in the growing DeFi ecosystem. With WBTC, they can unlock the value of their Bitcoin while still retaining exposure to Bitcoin's price movements. The result is an expansion of the market for DeFi, with increased liquidity and volume in dApps.

In summary, WBTC plays an integral role in the DeFi sector by acting as a bridge between Bitcoin and Ethereum's ecosystems. This bridge opens up a world of possibilities for Bitcoin holders looking to tap into Ethereum's vast DeFi landscape. Whether you're interested in trading, lending, borrowing, or yield farming, WBTC provides a way to leverage your Bitcoin in ways that were previously inaccessible.

Understanding the functionality of Wrapped Bitcoin (WBTC) is key to grasping its role in the blockchain and cryptocurrency ecosystem. This section explores how WBTC acts as a bridge between blockchains and its use in trading and lending.

WBTC is a type of cryptocurrency that represents Bitcoin (BTC) on the Ethereum blockchain. It serves as a bridge between the Bitcoin and Ethereum blockchains, enabling Bitcoin holders to participate in the Ethereum ecosystem without needing to convert their BTC into Ether (ETH).

The creation of WBTC involves depositing BTC into a custodial vault, and the equivalent amount of WBTC is minted on the Ethereum blockchain. This process, known as 'wrapping', allows Bitcoin to be used in Ethereum's Decentralized Finance (DeFi) applications, expanding its utility beyond the Bitcoin network.

Through WBTC, Bitcoin's value can be unleashed on Ethereum's network, opening up a world of possibilities for Bitcoin holders. It allows them to leverage the advantages of both blockchains: Bitcoin's store of value characteristic and Ethereum's smart contract capabilities.

WBTC can be traded on decentralized exchanges (DEXs) and used as collateral for loans in DeFi lending platforms. It provides enhanced liquidity for Bitcoin holders in the Web3 ecosystem, making it compatible with various DEXs and lending protocols. This functionality enables seamless trading and lending opportunities.

WBTC is a popular choice for Bitcoin holders who want to participate in the growing DeFi ecosystem. It provides a way to unlock the value of Bitcoin while still retaining exposure to its price movements. WBTC can be used as collateral for loans, provide liquidity to decentralized exchanges, and be integrated into various yield farming and staking protocols.

Given the growing interest in DeFi and the increasing acceptance of cryptocurrencies, WBTC is poised to play a crucial role as a bridge between traditional and decentralized finance.

The governance model of Wrapped Bitcoin (WBTC) is a crucial aspect to understand when exploring the question of 'what is Wrapped Bitcoin'. This model involves multiple entities, each playing a specific role to ensure transparency, decentralization, and security in the WBTC ecosystem.

The custodians of WBTC are responsible for holding and safeguarding the Bitcoin reserves that back the WBTC tokens. These custodians ensure that for every WBTC token minted, there is an equivalent amount of Bitcoin held in reserve. This model provides a direct link between the value of WBTC and Bitcoin, thereby maintaining the stability of the WBTC token.

There are multiple entities involved in the creation and custody of WBTC. These include merchants who interact with users, custodians who hold the Bitcoin reserves, and the WBTC DAO (Decentralized Autonomous Organization) which governs the token and its operations.

However, it's important to note that WBTC operates through a custodial model where a centralized entity holds the underlying Bitcoin. This introduces a counterparty risk. Users need to consider the reputation and security measures of the custodian when using WBTC.

Transparency and auditability are key elements of the WBTC governance model. Since the custodians of WBTC hold the Bitcoin reserves that back the WBTC tokens, they are able to provide proof of reserves, ensuring that every WBTC token in circulation is backed by an equivalent amount of Bitcoin.

The WBTC DAO governs the token and its operations, providing a decentralized governance model that ensures transparency and accountability. The DAO includes multiple entities, each playing a specific role in the governance of the token. The multi-entity model helps to ensure that the operations of WBTC are transparent, decentralized, and secure.

Transparency and auditability are essential for maintaining trust in the WBTC ecosystem. As a user, you can verify that your WBTC tokens are backed by an equivalent amount of Bitcoin by checking the proof of reserves provided by the custodians. This transparency allows you to trust the value of your WBTC tokens and use them with confidence in various decentralized applications and smart contracts.

Understanding the governance model of WBTC is essential for answering the question of 'what is Wrapped Bitcoin'. It provides insights into how WBTC operates, how it maintains its value, and how it ensures transparency and security. For more information on other blockchain technologies and cryptocurrencies, explore our guides on IOTA, Conflux, Curve DAO, and Algorand.

While understanding 'what is wrapped bitcoin' and its potential in the DeFi space is important, it's also crucial to be aware of the risks and considerations associated with WBTC.

The process of wrapping Bitcoin involves depositing Bitcoin with a custodian, who then mints the equivalent amount of WBTC on the Ethereum blockchain. However, this process is not automated via a smart contract on the Ethereum blockchain, but is usually done instantaneously via a central program, which can be subject to manipulation.

Furthermore, the trustworthiness of some wrapped assets is questionable because they depend on the platform that issues them, which can lead to centralization and potential abuse of power. The custodians of WBTC are responsible for holding and safeguarding the Bitcoin reserves that back the WBTC tokens, ensuring transparency and auditability. However, the centralized nature of this process does introduce certain risks.

Another key risk associated with WBTC is counterparty risk. Despite its decentralized premise, WBTC operates through a custodial model where a centralized entity holds the underlying Bitcoin. This introduces a counterparty risk, where users must trust the custodian to hold and manage the Bitcoin reserves.

Users need to consider the reputation and security measures of the custodian when using WBTC. If the custodian were to become insolvent or act in bad faith, the WBTC tokens could potentially lose their backing, leading to a loss of value.

While WBTC presents many opportunities, it's essential to understand the risks and trade-offs involved. Like any investment, a thorough assessment should be performed before deciding to use WBTC.

The integration of Wrapped Bitcoin (WBTC) into the cryptocurrency ecosystem has had a profound impact on both the market for decentralized finance (DeFi) and the overall functionality of decentralized applications (DApps).

Wrapped Bitcoin (WBTC), a tokenized version of Bitcoin on the Ethereum blockchain, has aided in the expansion of the market for DeFi protocols. The primary purpose of WBTC is to bring liquidity to the Ethereum ecosystem and enable Bitcoin holders to participate in decentralized finance (DeFi) applications.

The creation of WBTC has not only helped to increase the addressable market for DeFi protocols but has also injected liquidity and volume from assets like Bitcoin into DApps. This development has provided Bitcoin holders with the unique opportunity to participate in the DeFi ecosystem, while retaining exposure to Bitcoin price movements.

WBTC can be used as collateral for loans, provide liquidity to decentralized exchanges, and be integrated into various yield farming and staking protocols.

In addition to expanding the market for DeFi, WBTC has significantly contributed to the liquidity and volume in DApps. WBTC tokens represent Bitcoin on the Ethereum blockchain, making them compatible with various decentralized exchanges (DEXs) and lending protocols.

This compatibility facilitates seamless trading and lending opportunities for Bitcoin holders in the Web3 ecosystem. Additionally, WBTC can be traded on decentralized exchanges (DEXs) and used as collateral for loans in DeFi lending platforms.

The adoption of WBTC has been widespread, with billions of dollars worth of WBTC in circulation. This adoption has been driven by the demand for Bitcoin exposure in the DeFi space, as well as the ability to earn yield and access various decentralized financial services using WBTC.

The impact of WBTC on the cryptocurrency ecosystem is significant, signifying a step forward in interoperability and the potential for Bitcoin to be leveraged in new and innovative ways. To explore other exciting technologies in the blockchain and cryptocurrency space, check out articles on what is iota, what is conflux, what is curve dao, and what is algorand.

As we look into the future of Wrapped Bitcoin (WBTC), two key areas of focus emerge: adoption and liquidity, and the potential for growth and innovation.

WBTC has already gained significant adoption and liquidity in the cryptocurrency market, with billions of dollars worth of WBTC in circulation. This widespread adoption has been driven by the demand for Bitcoin exposure in the DeFi space, as well as the ability to earn yield and access various decentralized financial services using WBTC.

By acting as a bridge between Bitcoin and Ethereum, WBTC provides enhanced liquidity for Bitcoin holders in the Web3 ecosystem, making it compatible with various decentralized exchanges (DEXs) and lending protocols. This enables seamless trading and lending opportunities.

The future growth and innovation of WBTC rests largely on its ability to expand the addressable market for DeFi protocols and inject liquidity and volume from assets like Bitcoin into DApps.

Furthermore, WBTC opens up possibilities for developers and users by allowing Bitcoin to be utilized in Ethereum-based smart contracts, DeFi applications, and other decentralized services, thereby expanding Bitcoin's functionality and use cases.

WBTC is a popular choice for Bitcoin holders who want to participate in the growing DeFi ecosystem. It provides a way to unlock the value of Bitcoin while still retaining exposure to its price movements. WBTC can be used as collateral for loans, provide liquidity to decentralized exchanges, and be integrated into various yield farming and staking protocols.

As the adoption of cryptocurrencies continues to grow, and as more individuals and institutions turn to decentralized financial services, the potential for WBTC to drive innovation and growth in the cryptocurrency space is significant. Given its unique properties and capabilities, WBTC is well-positioned to be a key player in the future of decentralized finance.

Sharding is a process of breaking down a blockchain into smaller segments that is aimed to improve the transaction costs and speed.