Buy Crypto

Assets

It is impossible to talk about the crypto industry without talking about the stablecoins. They've got the best of both worlds of finance: fast and borderless transactions of assets, without the rice fluctuations. And with the constantly growing market capitalization of stablecoins, some could even argue that the stablecoins have reached their peak. Some, but not Justin Sun who has introduced Decentralized USD, or USDD. According to him, this fully decentralized stablecoin is the first step into the new generation of stablecoins. In this article we'll look at how USDD works, what makes it different from other stablecoins, as well as how to get it, and where to keep it if you decide to invest in USDD.

Decentralized USD, or USDD is an algorithmic stablecoin introduced by Justin Sun, founder of the Tron DAO. Its value is pegged to the value of the US dollar, similar to USDC, USDT, and other USD stablecoins. While it was launched by TRON DAO Reserve, it doesn't mean that the token is exclusive to that blockchain. USDD is also present on the NEAR blockchain as well as Ethereum and Binance Smart Chain.

The person behind USDD is Justin Sun. Since graduating with a BA in History from Peking University and an MA in Political Economy from the University of Pennsylvania, Sun has made quite a name for himself. Before USDD he was primarily known as the founder of the TRON network back in 2017. Tron is a cryptocurrency that provides users with decentralized peer-to-peer content and entertainment-sharing ecosystem.

The organization that issued USDD is TRON DAO Reserve. It's a decentralized autonomous organization created by the TRON Network. The stated goals of the DAO are to overall protect the crypto market, prevent panic trading, and minimize severe economic downturns. The organization also oversees TRON-based stablecoins and ensures their price stability.

Unlike its predecessor UST, which was mostly collateralized by LUNA, USDD is backed by a combination of crypto assets, including $580 million worth of TRX, $235 million of BTC, and $442 million of USDC. While the heavy reliance on Tron's TRX token for almost 40% of the collateral raises concerns, USDD uses a strategy of over-collateralization to ensure stability. The basket of assets backing USDD accounts for over 200% of its circulating value, providing more than double the value to prevent it from de-pegging from the USD.

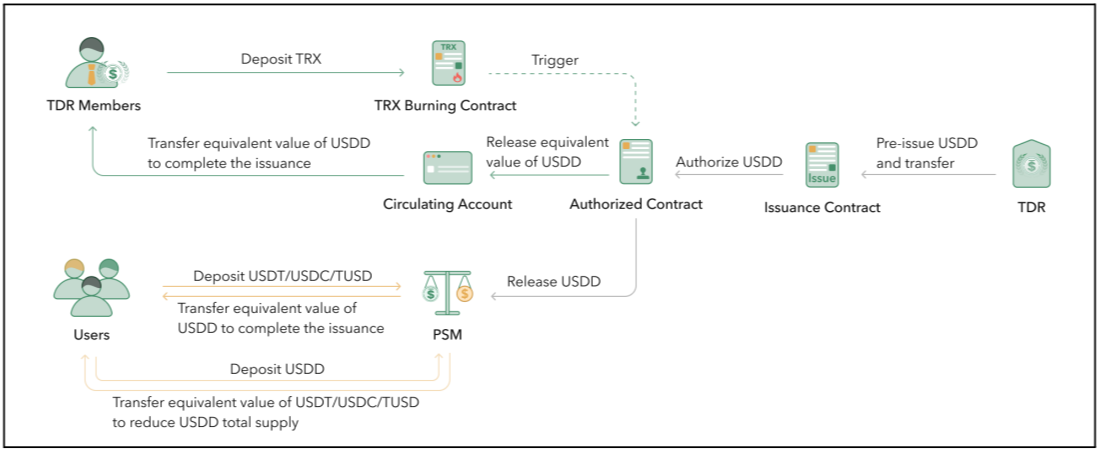

Additionally, USDD protocol employs a mint-and-burn mechanism, allowing users to exchange 1 USDD for 1 USD worth of TRX when the price is lower than $1, and vice versa when the price is higher. This mechanism aims to maintain a 1:1 peg with the USD.

Furthermore, USDD offers a Peg Stability Module (PSM), which enables users to swap their tokens with other stablecoins at a 1:1 rate, ensuring minimal slippage. To further support price stability, USDD involves a group of 27 Super Representatives who hold TRX tokens and are responsible for absorbing the impact of high volatility. These Representatives can apply for the position and are voted by TRX holders, adding a democratic element to the stability of the stablecoin.

Unlike most stablecoins, USDD can be mined. is indeed possible and is available on designated mining platforms (such as SunSwap, for example) or Poloniex - the centralized platform. TRON DAO Reserve works with designated platforms that promise up to 30% APR.

The second type is cooperative mining, with the interest rate for returns jointly supported by TRON DAO Reserve and will fluctuate around 30% APR. TRON DAO Reserve will do its best to ensure a stable interest rate for cooperative mining returns.

USDD is not the only stablecoin on the market. There is BUSD, USDT, USDC, and many others. All the stablecoins serve more or less the same purpose: give people the ability to transfer funds via blockchain without worrying about price fluctuations which are an integral part of crypto. Stablecoins differ in the way they keep the price stable, their market cap, circulating supply, trading volume, and so on.

USDD is currently the seventh stablecoin by market cap, being only outperformed by USDT and USDC. When it comes to trading volume, however, the situation is not as impressive. This volume is measured by tens of millions for USDD, billions for USDC, and tens of billions for USDT. It doesn't necessarily mean that USDT is more reliable per se, however, it does show a clear distrust toward the algorithmic stablecoins, especially after the story with UST (which was also an algorithmic stablecoin that lost its peg).

Since USDT and USDC also have a longer history, they enjoy more of an adoption rate in the DeFi space and exchange platforms. In other words, it will be simply easier to get your USDT or USDC traded in comparison to USDD. If you wish to learn more about stablecoins, USDC, and USDT in particular, check out our comparison article here.

If you are interested in investing in USDD, you can get it via most exchange platforms. Popular options for purchasing USDD include Bybit, Gate.io, Poloniex, KuCoin, and Huobi Global. The current price of USDD fluctuates between $0.97 and $1.00, with a brief period of depegging in mid-June.

To buy USDD on an exchange platform, you will need to create an account. This process typically takes only a few minutes and requires an email address and a mobile phone for multi-factor authentication. Once your account is set up, you can proceed to deposit funds. These cryptocurrency holdings can then be used to purchase USDD within the platform.

There is a ton of options for storage when it comes to USDD, since the token is present on so many blockchain networks. If you purchased an ERC-20 or BEP-20 version of USDD, you can keep your USDD in a safe and decentralized manner in Atomic Wallet.

Atomic Wallet supports all ERC-20 tokens and BSC tokens, even if some of them are not enabled by default. Simply deposit the token to your Ethereum address in the wallet and you'll be able to store and manage your USDD in Atomic Wallet.

Other popular options include Trust Wallet, Metamask, and others.

At the time of writing this article, (02.08.2023), the USDD price sits at $0.997656.

Over the last 24 hours, the trading volume for USDD was $24,203,250.

The highest price paid for USDD of $1.04 was reached on November 9, 2022.

At the time of writing this article (02.08.2023), the circulating supply is 737,137,986 USDD.

Sharding is a process of breaking down a blockchain into smaller segments that is aimed to improve the transaction costs and speed.